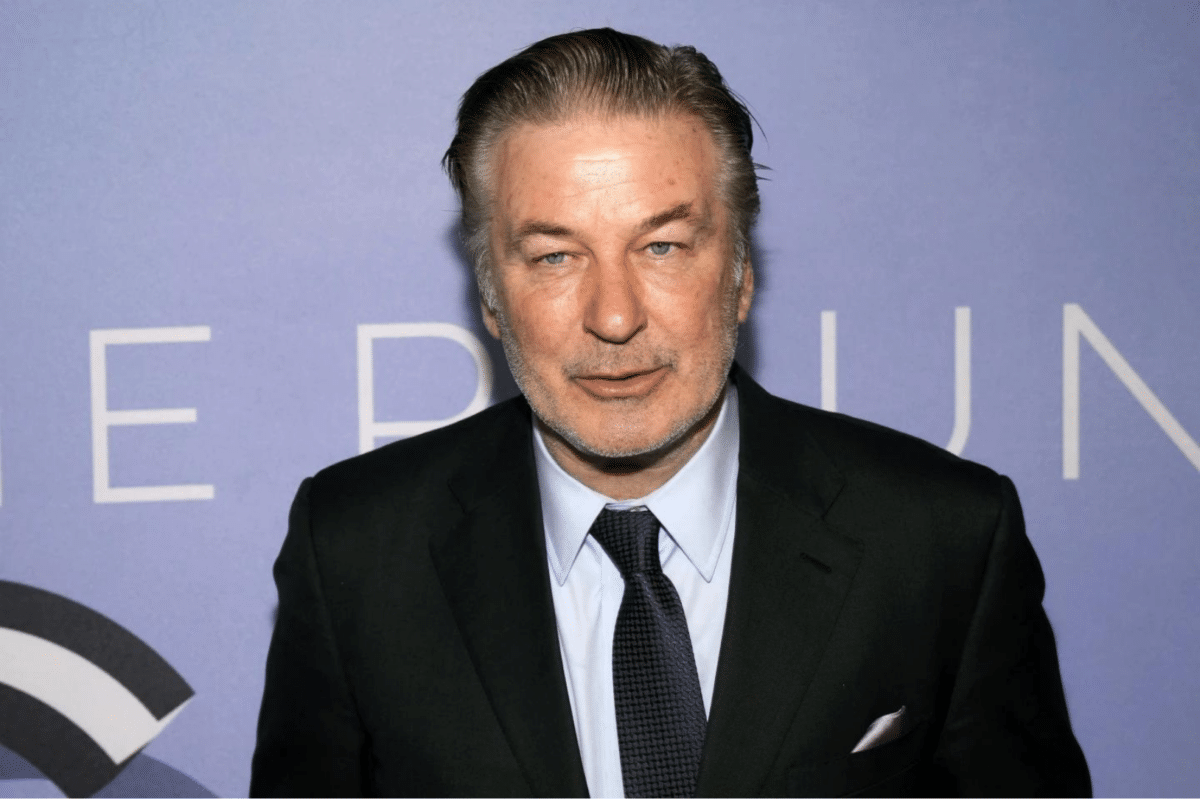

Alec Baldwin. Picture: Charles Sykes/Invision/AP

SANTA FE, New Mexico — Producers of the Western film “Rust” might must forgo a sturdy financial incentive as they attempt to promote the movie to distributors and fulfill monetary obligations to the instant household of a cinematographer who was fatally shot by Alec Baldwin throughout a rehearsal in 2021.

New Mexico tax authorities denied an software this spring by Rust Film Productions for incentives value as a lot as $1.6 million, in keeping with paperwork obtained by The Related Press. A late July deadline for producers to attraction the choice is approaching.

In the meantime, Baldwin is scheduled to go on trial beginning subsequent week on an involuntary manslaughter cost in Halyna Hutchins’ dying. The lead actor and co-producer of “Rust” was pointing a gun at Hutchins when it went off, killing her and wounding director Joel Souza.

Melina Spadone, an lawyer representing the manufacturing firm, stated the movie manufacturing tax incentive was going for use to finance a authorized settlement between producers and Hutchins’ widower and son.

“The denial of the tax credit score has disrupted these monetary preparations,” stated Spadone, a New York- and Los Angeles-based senior counsel at Pillsbury Winthrop Shaw Pittman. She helped dealer the 2022 settlement that rebooted the stalled manufacturing of “Rust” in Montana with among the authentic solid and crew, together with Baldwin and Souza. Filming wrapped up final 12 months.

Phrases of the settlement are confidential, however producers say ending the movie was meant to honor Hutchins’ creative imaginative and prescient and generate cash for her younger son.

Courtroom paperwork point out that settlement funds are as much as a 12 months late, as attorneys for Hutchins’ widower decide “subsequent steps” that embrace whether or not to renew wrongful dying litigation or provoke new claims. Authorized representatives for Matthew Hutchins didn’t reply to phone and e mail messages looking for remark.

The prosecution of Baldwin and the movie’s tax incentive software each have monetary implications for New Mexico taxpayers. The Santa Fe district lawyer’s workplace says it spent $625,000 on “Rust”-related prosecution by way of the top of April.

The state’s movie incentives program is among the many most beneficiant within the nation, providing a direct rebate of between 25% and 40% on an array of expenditures to entice film tasks, employment, and infrastructure investments. As a share of the state funds, solely Georgia pays out extra in incentives.

FILE PHOTO: Actor Alec Baldwin departs his residence, as he will likely be charged with involuntary manslaughter for the deadly taking pictures of cinematographer Halyna Hutchins on the set of the film “Rust”, in New York, United States, January 31, 2023. REUTERS/David ‘Dee’ Delgado

It features a one-time choice to assign the cost to a monetary establishment. That lets producers use the rebate to underwrite manufacturing forward of time, usually layering rights to the rebate and future film earnings into manufacturing loans.

Among the many beneficiaries of the rebate program are the 2011 film “Cowboys and Aliens” and the TV sequence “Higher Name Saul,” a derivative of “Breaking Dangerous.” As for present productions, New Mexico is the backdrop for a brand new movie starring Matthew McConaughey and America Ferrera in regards to the rescue of scholars in a 2018 wildfire within the city of Paradise — essentially the most damaging in California’s historical past.

Charlie Moore, a spokesperson for the New Mexico Taxation and Income Division, declined to remark particularly on the “Rust” software, citing considerations about confidential taxpayer info. Purposes are reviewed for a protracted record of accounting and declare necessities.

Throughout a current 12-month interval, 56 movie incentive purposes had been permitted and 43 had been partially or absolutely denied, Moore stated.

Paperwork obtained by AP present the New Mexico Movie Workplace issued a memo in January to “Rust” that permitted eligibility to use for the tax incentive, in a course of that entails accounting ledgers, vetting towards excellent money owed, and an on-screen closing credit score to New Mexico as a filming location. Taxation officers have the ultimate say on whether or not bills are eligible.

Spadone, the lawyer for “Rust,” stated the denial of the applying is “shocking” and will disrupt confidence within the tax program with a chilling impact on rebate-backed loans that propel the native movie business.

Alton Walpole, a manufacturing supervisor at Santa Fe-based Mountainair Movies who was not concerned in “Rust,” stated he faults the film’s creators for seemingly chopping corners on security however officers should assessment its tax credit score software based mostly on authorized and accounting ideas solely — or threat shedding main tasks to different states. Films are inherently harmful even with out firearms on set, he famous.

“They’re going to say, ‘Wait, are we going to New Mexico? They might deny the rebate,’” Walpole stated. “They’re watching each penny.”

“Well-liked opinion? I’d say don’t give them the rebate. However legally, I believe they certified for all of it,” he stated.

Actor Alec Baldwin leaves courtroom within the Manhattan borough of New York Metropolis, New York, United States, January 23, 2019. REUTERS/Carlo Allegri/File Picture

A minimum of 18 states have enacted measures to implement or increase movie tax incentives since 2021, whereas some have gone in the wrong way and sought to restrict the transferability and refundability of credit score.

Beneath Democratic Gov. Michelle Lujan Grisham, New Mexico has raised annual spending caps and expanded the movie tax credit score amid a multibillion-dollar surplus linked to report oil and pure gasoline manufacturing. Movie rebate payouts had been $100 million within the fiscal 12 months ending in June 2023 and are anticipated to rise to just about $272 million by 2027, in keeping with tax company information and the Legislature’s funds and accountability workplace.

Democratic state Sen. George Muñoz has criticized the inducement program and requested whether or not taxpayers needs to be liable for unexpected bills.

“If we’re going to do tax credit and there’s an issue on the movie or the set, do they actually qualify or do they disqualify themselves?” stated Muñoz, chairman of the lead Senate budget-writing committee.

“Rust” doesn’t but have a U.S. distributor as producers store the newly accomplished film at movie festivals.